Revolutionizing USDC Interoperability Across Blockchains

In the rapidly evolving world of blockchain technology, interoperability between different networks is a critical challenge. As decentralized finance (DeFi), payments, and Web3 applications expand across multiple blockchains, the need for seamless, secure, and efficient cross-chain asset transfers has never been greater. Circle, the issuer of the USDC stablecoin, has addressed this challenge with its Cross-Chain Transfer Protocol (CCTP), a permissionless on-chain utility designed to enable native USDC transfers between supported blockchains. This article explores how CCTP works, its benefits, and why it’s a game-changer for developers and users alike. For more details, visit Circle’s official CCTP page.

What is Circle’s Cross-Chain Transfer Protocol (CCTP)?s

Introduced in 2023, CCTP is a protocol developed by Circle to facilitate the secure and capital-efficient transfer of USDC, the second-largest stablecoin with a circulating supply of over $58 billion, across multiple blockchains. Unlike traditional bridging methods that rely on locking tokens on one chain and minting wrapped versions on another, CCTP uses a burn-and-mint mechanism. This process effectively “teleports” USDC from one blockchain to another, ensuring that users always interact with native USDC, not synthetic or wrapped derivatives.

CCTP is currently available on major blockchains, including Arbitrum, Avalanche, Base, Ethereum, Noble, OP Mainnet, Polygon PoS, Solana, and Sui, with support for Aptos and Unichain planned for the near future. By unifying liquidity and simplifying the user experience, CCTP addresses key pain points in cross-chain transactions, such as fragmentation, security risks, and capital inefficiency.

How Does Circle CCTP Work?

How Does CCTP Work?CCTP operates through a straightforward yet secure process that ensures 1:1 capital efficiency and eliminates the need for liquidity pools or third-party providers. Here’s a step-by-step breakdown of how it works:

- Initiate Transfer: A user accesses an application (e.g., a wallet, bridge, or DeFi platform) to transfer USDC from one blockchain (source chain) to another (destination chain). The user specifies the recipient wallet address on the destination chain.

- Burn USDC on Source Chain: The application facilitates the burning of the specified amount of USDC on the source chain. This removes the tokens from circulation on that network.

- Circle’s Attestation: Circle observes and attests to the burn event, providing a signed attestation that authorizes the minting of an equivalent amount of USDC on the destination chain. With the Fast Transfer feature in CCTP V2, this attestation is available almost instantly.

- Mint USDC on Destination Chain: The application uses Circle’s attestation to mint the exact amount of USDC on the destination chain, which is then sent to the recipient’s wallet address.

- Automated Actions with Hooks: CCTP V2 introduces Hooks, a feature that allows developers to program automated post-transfer actions, such as asset swaps, staking, or treasury management, enhancing the efficiency of DeFi applications.

This burn-and-mint process ensures that USDC remains fungible across chains, avoids slippage (a common issue with liquidity pool-based bridges), and minimizes trust assumptions since Circle, the trusted issuer of USDC, validates every transfer.

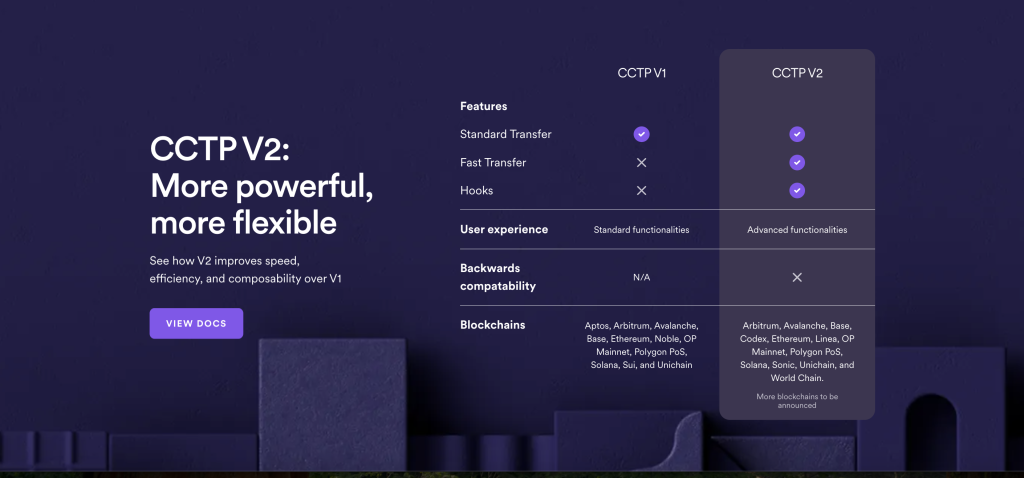

Circle CCTP V1 vs. V2: What’s New?

CCTP V2, launched in March 2025, builds on the success of CCTP V1 by introducing significant upgrades:

- Fast Transfer: Reduces settlement times to seconds, compared to minutes in V1, making it suitable for latency-sensitive applications.

- Hooks: Enables developers to automate post-transfer actions, such as swapping assets or managing treasury operations, directly on the destination chain.

- Expanded Network: V2 operates on a distinct set of smart contracts and APIs, forming its own network of supported blockchains. It is not backward compatible with V1, ensuring a clean slate for advanced functionalities.

While V1 is ideal for standard cross-chain transfers, V2 caters to developers seeking faster speeds and enhanced composability for complex DeFi and payment applications.

Why Circle CCTP Matters for Blockchain Bridges

For bridge directories like FindMyBridge.com, CCTP represents a significant advancement in cross-chain technology. By offering a secure, efficient, and user-friendly solution for transferring USDC, CCTP empowers developers to build bridges and applications that enhance blockchain interoperability. Its integration with popular platforms and wallets, such as OKX, MetaMask, XDEFI, and Chainlink, makes it a go-to choice for projects aiming to unify liquidity and simplify user experiences.

At FindMyBridge.com, we recognise CCTP as a cornerstone protocol for the future of cross-chain bridging. Whether you’re a developer looking to integrate CCTP into your bridge or a user seeking seamless USDC transfers, this protocol offers unmatched reliability and flexibility. Explore our directory to discover bridges that leverage CCTP and other cutting-edge technologies to connect the multi-chain ecosystem.

Want to explore your bridge options?

visit Find My Bridge