What are blockchain bridges?

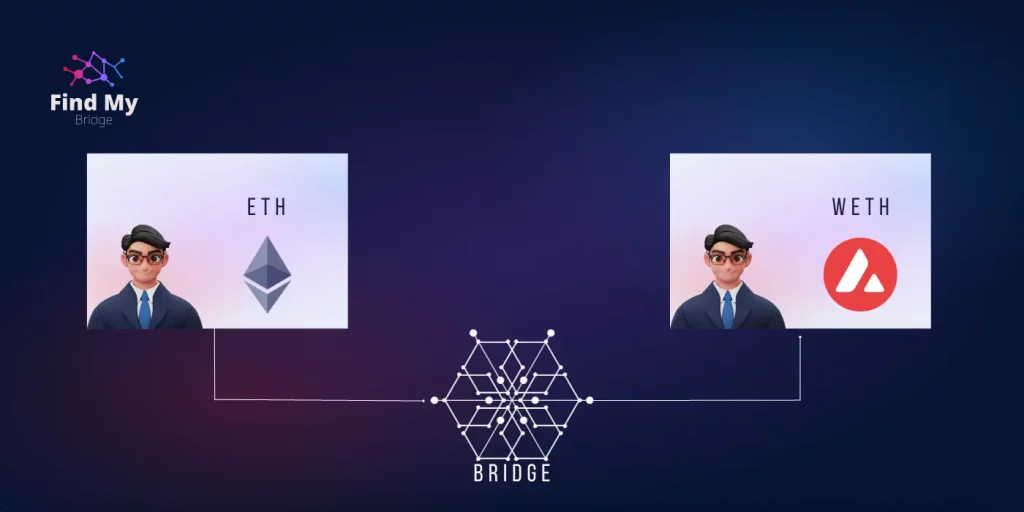

Blockchain bridges are like physical bridges as they connect two different places, but in this case, they connect two different blockchains.

This connection is crucial because without it, blockchains are isolated environments that cannot interact with each other due to different rules, governance mechanisms, assets, and data they possess.

However, thanks to bridges, crypto assets and data can be transferred between them, enabling interoperability and compatibility among different blockchain networks.

In summary, bridges are a fundamental element in the crypto world.

What types of bridges exist?

There are different types of bridges in the blockchain world. Some of the most common ones include:

- Sidechain bridges: These bridges allow asset transfers between a mainchain and a sidechain connected to it. Assets are locked on the mainchain and released on the corresponding sidechain.

- Cross-chain bridges: These bridges connect two different blockchains and enable asset and data transfers between them.

- Oracle bridges: These bridges integrate real-world external information into a blockchain, making it usable in smart contracts.

- Tokenization bridges: These bridges facilitate token creation on one chain and their representation on a different chain.

Digging deeper into bridge types:

- Sidechain bridges: As mentioned earlier, sidechain bridges connect a mainchain with a sidechain. Sidechains are independent blockchains that are connected to the mainchain through a bridge. Sidechain bridges allow for quick and efficient asset transfers between chains, primarily used for blockchain scalability.An example of a sidechain bridge is Plasma, which connects to the Ethereum blockchain.

- Cross-chain bridges: Cross-chain bridges connect two different blockchains, enabling asset and data transfers between them. These bridges are useful for connecting blockchains with different characteristics, such as different consensus algorithms or transaction validation protocols.An example of a cross-chain bridge is the Polkadot Network, which connects different blockchains to form an interoperable network.

- Oracle bridges: Oracle bridges allow external real-world information to be integrated into a blockchain for use in smart contracts. Oracles are external sources of information that provide real-world data, such as cryptocurrency prices or sports event outcomes. Oracle bridges are essential for creating more complex and useful smart contracts.An example of an oracle bridge is the Chainlink Network, used to integrate real-world data into blockchains.

- Tokenization bridges: Tokenization bridges enable the creation of tokens on one chain and their representation on another chain. These bridges are useful for creating tokens that can be used on different blockchains, increasing interoperability among chains.An example of a tokenization bridge is Wrapped Bitcoin (WBTC), allowing users to exchange Bitcoin tokens on the Ethereum blockchain.

Another way to classify bridges is based on how assets move:

- Lock & Mint: This type of bridge locks assets on one blockchain and issues a representation of those assets on another blockchain. For example, when someone wants to transfer Bitcoin to Ethereum, the Bitcoins are locked on the Bitcoin blockchain, and ERC-20 tokens representing the locked Bitcoins are issued on Ethereum. This process is carried out through a smart contract that validates the transaction and ensures that the issued tokens are backed by the locked assets.

- Burn & Mint: This type of bridge involves burning or destroying tokens on one blockchain and issuing new tokens on another blockchain. For example, when someone wants to transfer tokens from one blockchain to another, the tokens are burned on the original blockchain, and new tokens are issued on the destination blockchain. This process is facilitated by a smart contract that validates the transaction and ensures that the newly issued tokens are backed by the burned tokens.

- Atomic Swaps: This type of bridge enables direct token transfers between two blockchains without the need for an intermediary or centralized exchange. Atomic swaps use smart contracts that allow for simultaneous transactions without the need to trust a third party.

Classification of bridges based on how they work.

Trusted and Trustless

Trusted bridges rely on an intermediary or trusted third party to facilitate asset and data transfers between different blockchains. These intermediaries can be financial institutions, cryptocurrency exchanges, or other trusted organizations.

Trusted bridges are relatively easy to implement but carry the risk that the third party may be hacked or act maliciously, compromising transaction security.

On the other hand, trustless bridges do not depend on an intermediary or trusted third party to facilitate asset and data transfers between different blockchains. These bridges utilise smart contracts and other cryptographic mechanisms to ensure secure and reliable transactions without the need to trust a third party.

Trustless bridges are more complex to implement than trusted bridges but offer the advantage of enhanced security and reduced susceptibility to manipulation.

In summary

Blockchain bridges are important tools for connecting different blockchains, enhancing interoperability, and compatibility among them. For those considering using blockchain bridges, it is crucial to conduct thorough research and choose a solution that aligns with their specific needs and objectives.

Additionally, exercising caution when interacting with any bridge is important, ensuring a clear understanding of its functioning and verifying security before engaging in any transaction.